what is fsa health care 2022

According to the IRS the maximum amount an individual can contribute to the Healthcare FSA for 2022 is 2750. An FSA is a type of savings account that provides tax advantages.

The 2022 Fsa Contribution Limits Are Here

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. 13 hours agoIn 2022 the deductible is at least 2800 for a family and 1400 if youre single.

One advantage to a high-deductible health plan is that. The maximum amount you can contribute to the Dependent Care DAYCARE FSA is 5000 for a married couple filing a joint tax return or if. Healthcare FSAs are a type of spending account offered by employers.

This is an increase of 100 from the 2021. Obamacare Coverage from 30Month. A Health Flexible Spending Account FSA is an employer-sponsored reimbursement arrangement that allows employees to set aside pre-tax money on an annual basis to pay for qualified medical expenses.

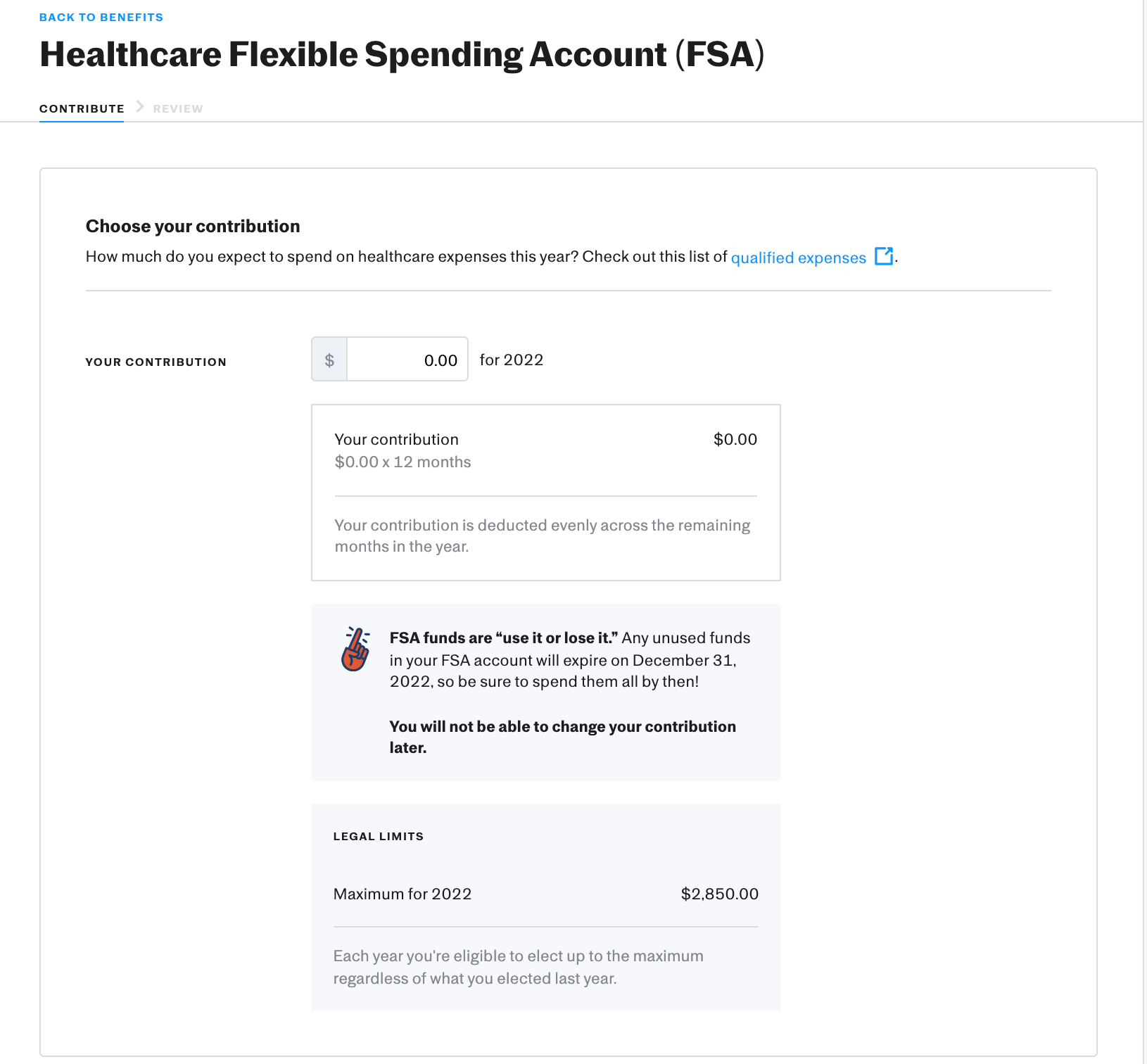

FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Its a smart simple way to save money while keeping you and your family healthy and protected.

Get a free demo. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA.

You dont pay taxes on this money. An FSA is a tool that may help employees manage their health care budget. The IRS allows you to roll over a maximum of 570 of unused funds to your next years FSA balance.

Affordable Healthcare Coverage for Families Individuals. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing.

Employers can offer either option for a. You can choose to add any amount up to this limit. You decide how much to put in an FSA up to a limit set by your employer.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide According to the IRS the maximum amount an individual can contribute to the Healthcare FSA for 2022 is 2750. For 2022 the maximum amount the IRS allows you to contribute to your healthcare FSA is 2850. Ad Custom benefits solutions for your business needs.

Check the Newest Plan Options. First Steps is available as soon as an individual knows they are pregnant and is covered by Washington Apple Health Medicaid. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

For Example Joe and Susan both have money left in their. Heres how a health and medical expense FSA works. Employers set the maximum amount that you can contribute.

Claims must be submitted to. Ad Health Insurance For 2022. Your FSA account funds reset each year.

Later you can use this money to pay for qualified expenses such as medical care health-related products and other services. Instantly See Prices Plans and Eligibility. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA.

Glucosamine Chondroitin Msm Vitamin D3 Joint Health Supplement Advanced Joint Support Tablets For Men Women With Vitamin D3 To Support Bone Immune Health Fa In 2022 Glucosamine Chondroitin Msm Chondroitin. You have until May 31 of the following year to submit them For DCAP you can submit claims. Ad Join 2 Million Satisfied Shoppers weve Helped Cover.

Plus if you re-enroll in FSAFEDS during Open Season you can. Employees can elect up to the IRS limit and still receive the employer contribution in addition. But the late announcement left.

Pre-tax dollars are put aside from your paycheck into your FSA. An FSA is not a savings account. Mabis Healthcare Cane Ice Grip Tip For Cane Crutch In 2022 Cane Tips Crutches Health Care.

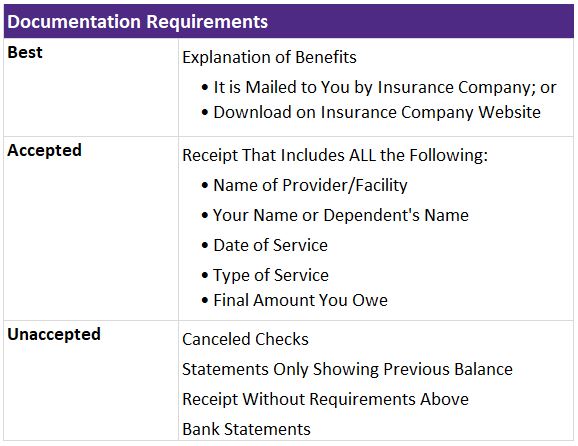

Under the act for both health and dependent care FSAs employers may do the following. The Health Care Flexible Spending Account HCFSA administered by HealthEquity provides you with a way to pay for eligible health care expenses with pre-tax dollars. Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices.

When used it can be a great tax savings tool to effectively pay for. Browse Personalized Plans Enroll Today Save 60. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect.

If you have adopted a 570 rollover for the health care FSA in 2022 any. Like health care FSAs dependent care accounts are offered by employers to allow workers to set aside pretax money in this case to cover the expenses of caring for children or other family. Get a Quote Now.

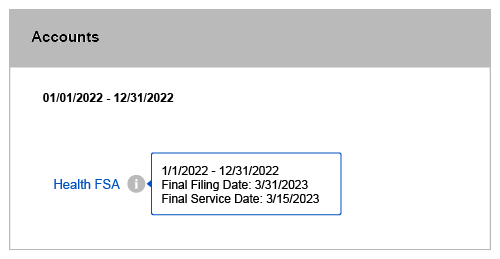

Allow participants to carry over FSA balances remaining at the end of the a 2020 plan year to the 2021 plan year and b 2021 plan year into the 2022 plan year 2. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Health FSA and DCAP contributions end with your last paycheck If you have funds remaining in your Health FSA you can submit claims for expenses incurred between January 1 of the current year and your termination date.

With a health care FSA only employers can allow you to carry over up to 570 from 2022 to the following year. Easy implementation and comprehensive employee education available 247. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

Extend grace periods to 12 months for plan years ending in 2021 and 2022 and 3. If you have a dependent care FSA pay special attention to the limit change. However it cant exceed the IRS limit 2750 in 2021.

If you enroll in a 2022 FSA only qualified expenses incurred between January 1 2022 and December 31 2022 will be eligible for reimbursement. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. Elevate your health benefits.

Your employer may also choose to contribute. In addition as part of COVID-19 relief the.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Contribution Limits For 2022 Goodrx

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Health Care And Limited Use Fsa Human Resources Northwestern University

Irs Releases Fsa Contribution Limits For 2022 Primepay

Hsa Vs Fsa What S The Difference Quick Reference Chart

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Understanding The Year End Spending Rules For Your Health Account

Flexible Spending Account Contribution Limits For 2022 Goodrx

Don T Forget To File April 15 Is The Deadline To File 2021 Health Fsa Claims Ucnet

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

Understanding The Year End Spending Rules For Your Health Account

Flexible Spending Account Contribution Limits For 2022 Goodrx

What Is A Dependent Care Fsa Wex Inc

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference